capital gains tax news canada

Your short-term capital gains are taxed at the same rate as your marginal tax rate tax. Investors pay Canadian capital gains tax on 50 of the capital gain amount.

Taxation Of Investment Income Within A Corporation Manulife Investment Management

The total amount you received when you sold the shares was 5000.

. Wed like to avoid this if possible. For example on a capital gain of. How to calculate how to report Schedule 3 Adjusted Cost Base ACB.

Marlena is 60 single and. All three properties were purchased in the 1970s so theres a hefty capital gains tax to be paid when we sell or die. Up to 15 cash back And if I may ask why do you want to avoid paying capital gains tax after realizing gains.

On 29 June 2021 private members Bill C-208 An Act to amend the Income Tax Act transfer of small business or family farm or fishing corporation received Royal. Since the inclusion rate for capital gains is 50 your taxable income would increase by 5000 in the 2021 tax year. Capital gains tax news canada Monday May 9 2022 Edit.

Subject to parliamentary approval the tax will apply beginning on September 1 2022. The sale price minus your ACB is the capital gain that youll need to pay tax on. Use Schedule 3 Capital gains or losses to calculate and report all your capital gains and losses.

The origin of capital gains taxation in Canada can be traced to the Carter commission appointed in September 1962 to thoroughly review the Canadian tax system. Canadians pay a 50 tax on all of their. Your new cost basis as of Year 5 would be 850000.

In Canada the capital gains inclusion rate is 50. The New Democratic Party NDP in particular pledges to increase the capital gains rate to 75. On August 9 2022 the Canadian federal government released a package of draft legislation to implement various tax measures update certain previously released draft.

The capital gains tax rate in Canada can be calculated by adding the income tax rate in each province with the federal income tax rate and then multiplying by the 50 capital. When investors sell a capital property for more than they paid for it the Canada Revenue Agency CRA applies a tax on half. Congratulations now that you have earned a profit on your investment report it on your tax return because it is a taxable capital gain.

Bullion and coins are liable to capital gains tax across Canada subject to personal-use property exemptions. Information for individuals on capital gains capital losses and related topics. Since its more than your ACB you have a capital gain.

Different types of realized capital gains are taxed by. Multiply 5000 by the tax rate listed according to your annual income minus any selling costs. This means that if you earn 1000 in capital gains and you are in the highest tax bracket in say.

Do not include any capital gains or losses in your business or property income even if you. However you would be. Capital gains tax will be payable to Canada on your share of the profit made on the sale 2.

The listed personal property rules state that coins with a resale value. The taxable portion of 125000 250000 capital gain x 50 inclusion rate is taxed at your marginal tax rate. If you earned a capital gain of 10000 on an investment 5000 of that is taxable.

The current tax preference for capital gains. When you sold the 100 shares this year you received 50 per share and paid a 50 commission. Your sale price 3950- your ACB 13002650.

To address wealth inequality and to improve functioning of our tax system tax rates on capital gains income should be increased. You pay CGT after realizing the gains. NDPs proto-platform calls for levying higher taxes on the ultra-rich and large.

The tax youll pay will.

Capital Gains Tax In Canada Explained

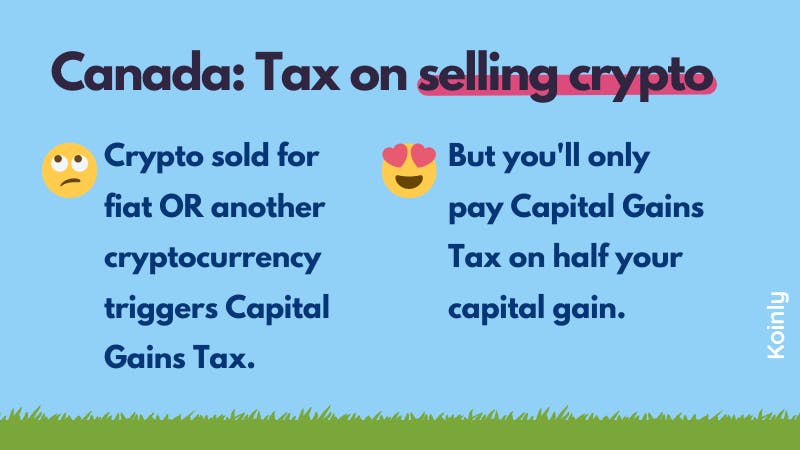

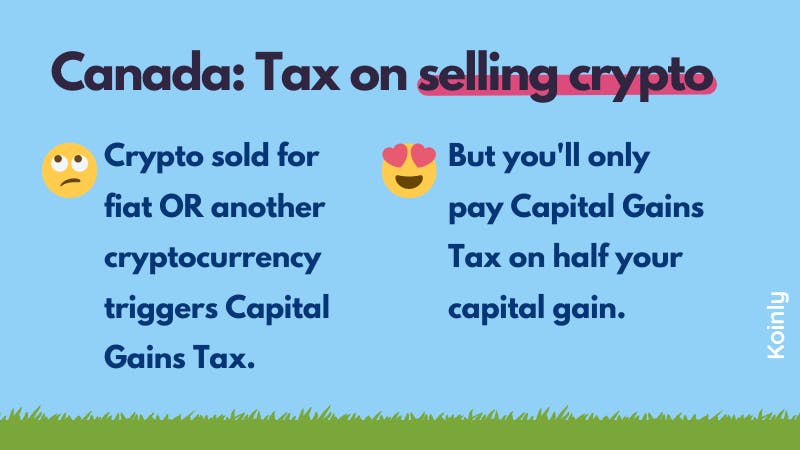

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Capital Gains Losses From Selling Assets Reporting And Taxes

Capital Gains Tax What It Is How It Works Seeking Alpha

Canada Capital Gains Tax Calculator 2022

How To Avoid Capital Gains Tax In Canada Remitbee

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Taxation Of Investment Income Within A Corporation Manulife Investment Management

2022 Capital Gains Tax Rates In Europe Tax Foundation

Canada Crypto Tax The Ultimate 2022 Guide Koinly

How Capital Gains Tax Works In Canada Forbes Advisor Canada

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Understanding The Lifetime Capital Gains Exemption And Its Benefits Davis Martindale Blog

Canada Crypto Tax The Ultimate 2022 Guide Koinly

Is Bitcoin Taxable In Canada Toronto Tax Lawyer

Canada Crypto Tax The Ultimate 2022 Guide Koinly